Resources

What problem did Nelson Nash resolve about IBC

Nelson Nash, the creator of the Infinite Banking Concept (IBC), aimed to address a problem he saw in how people handle money—specifically, their reliance on traditional banking institutions and loans to finance personal and business expenses. The main issues Nash sought to resolve were:

- Dependence on Third-Party Banks:

- Nash identified that individuals and businesses frequently depend on banks for loans, which results in paying significant interest to third-party institutions over a lifetime. He believed that this reliance put people at a financial disadvantage.

- Loss of Control Over Money:

- By using traditional banks, people often lose control over their finances. They give up their money in savings accounts or to lenders, who control the terms of loans and interest rates, rather than being in control of their capital.

- Inefficiencies in Wealth Growth:

- He saw inefficiencies in how people accumulate wealth. People were working to build savings in banks while simultaneously paying interest on loans to the same institutions, reducing their ability to grow wealth effectively.

The Solution: Infinite Banking Concept (IBC)

Nash’s IBC sought to solve these problems by encouraging individuals to “become their own banker.” Here is how it works:

- Utilize Whole Life Insurance: Nash advocated for the use of whole life insurance policies, particularly those that pay dividends, as a financial tool. Such policies build cash value over time.

- Access to Cash Value: Policyholders can borrow against the cash value of their life insurance policy, using the money to finance personal expenses or investments, much like a loan from a bank.

- Recapture Interest Payments: Instead of paying interest to an external bank, individuals repay the loan to themselves (their life insurance policy), effectively recapturing the interest they would have otherwise lost to a third-party institution.

- Control and Flexibility: By using their life insurance policy as a personal banking system, individuals maintain control over their capital, benefiting from compound growth within the policy while also using the funds when needed.

Summary of the Problem Resolved:

Nash’s IBC resolves the issue of losing money to third-party banks by empowering individuals to control their financial system. He gave people a strategy to finance their own needs, allowing them to keep more money and grow wealth more efficiently over time.

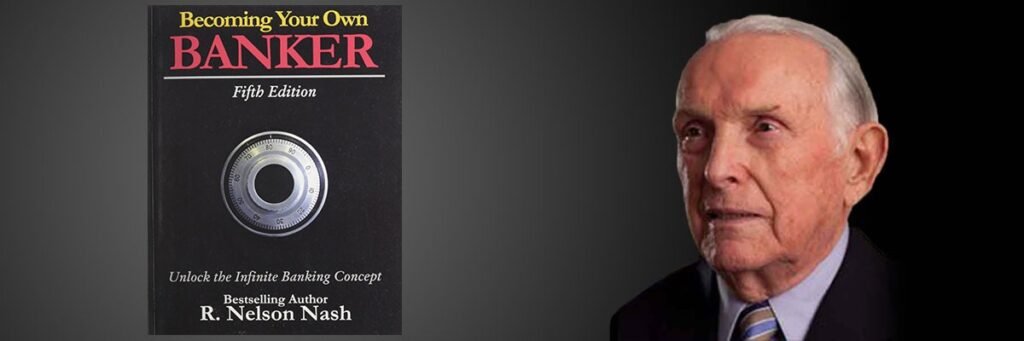

Recommended Books

“Becoming Your Own Banker©” reveals the power of dividend-paying whole life insurance through the lens of the infinite banking principle. The book illustrates how becoming your own banker can fulfill your lifelong financial needs far beyond mere protection, empowering you to build wealth and control your finances.